The Nomad board requested the creation of a more advanced investment application experience to demonstrate the future potential of the product to Nomad investors, positioning Nomad as a leader in innovation in the Fintech sector.

Strategic Challenge

Overview

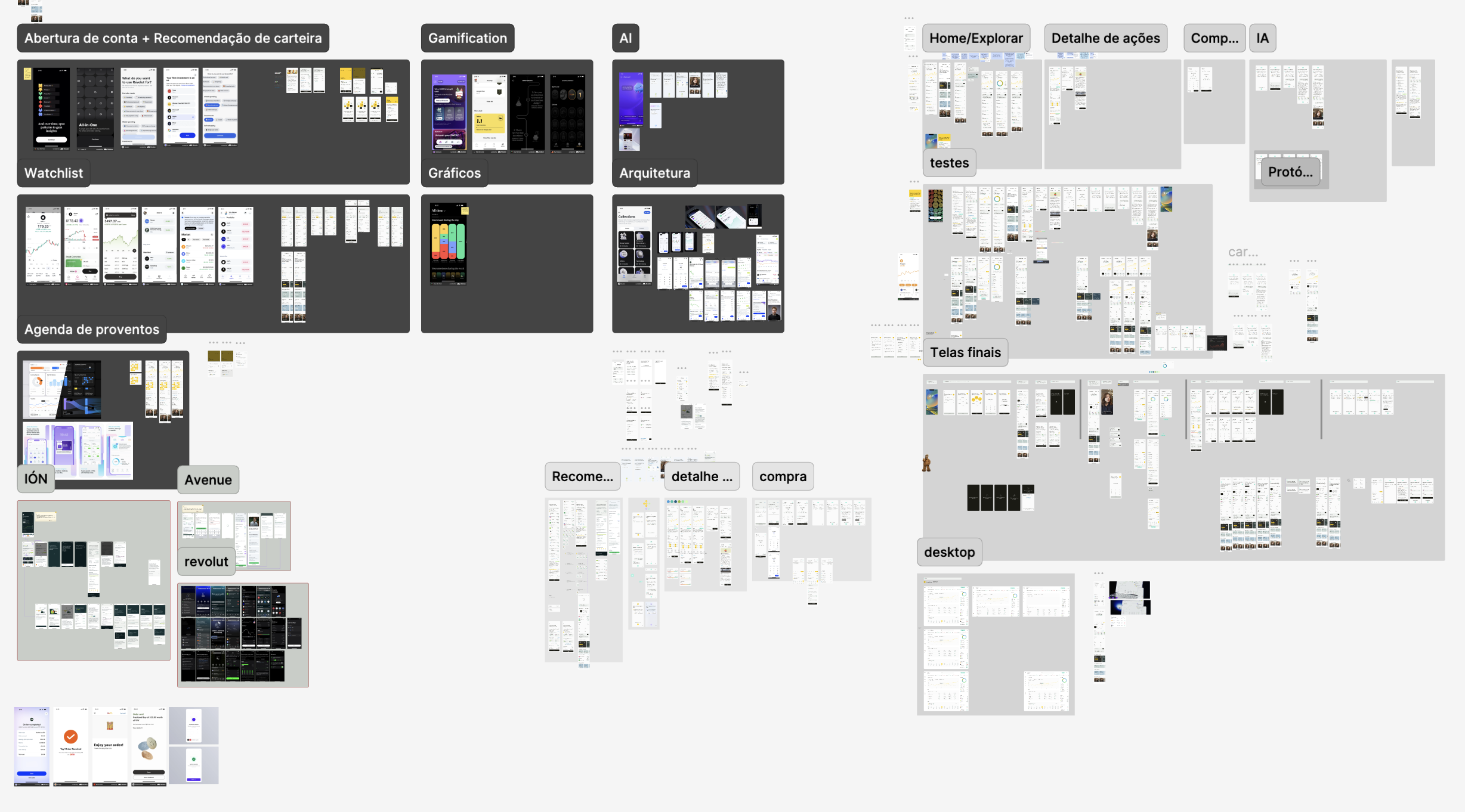

This innovation project involved a complete reimagination of the platform, including a new information architecture and the development of disruptive features such as wealth evolution, dividend charts, personalized portfolio based on client profile, AI insights, microinteractions to enhance the experience, new asset purchase journey, improved portfolio tracking, advanced custody filters, smart watchlist, and integrated fundamental analysis.

Context and Opportunities

Define Strategic Roadmap

for product medium/long term

Personalized Experiences

based on risk profile

Smart Insights

to help clients make decisions.

Process

Discovery

I conducted a detailed benchmarking with global fintech leaders such as Robinhood, Revolut, Publi, Avenue, Yahoo Finance, and Trade Republic, analyzing emerging trends in the international market and identifying specific gaps in the Brazilian market that represented innovation opportunities for Brazilian users to start investing in dollars and increasing retention of current customers.

Qualitative User Research

Conducted in-depth interviews with experienced investors to map current usage journeys, identify key pain points in the existing experience, and discover unmet needs that could be addressed through new features and design approaches.

Microinteractions and Animations to Elevate Visual Quality

My primary role in every design deliverable is to create designs not only functional but also emotionally engaging to be a competitive differentiator. Attractive and differentiated visual deliverables are what motivate me to work with design, and I am also beginning to assume a Design Specialist role in the team, as a career objective and professional evolution, to become a reference in the Design team at Nomad.

Solution

Intelligence and Personalization

A robust AI insights system that offers highly personalized recommendations based on each client's individual profile and historical behavior. This feature works together with the personalized portfolio, which uses automatic curation algorithms to select assets aligned with the user's risk profile and financial goals. Complementing this intelligent ecosystem, fundamental analysis integrates real-time financial data, providing a solid foundation for more informed and strategic decision-making.

Personalized Experience by Risk Profile

The wealth evolution feature allows users to visually track the performance of their investments over time through intuitive charts and detailed metrics, making it easier to understand portfolio growth. The dividends chart offers detailed tracking of dividends and other earnings, allowing investors to precisely monitor their returns. The watchlist complements this advanced experience with a monitoring system for assets and personalized alerts, ensuring users never miss important market opportunities.

Operational Flow Optimization

Redesigning critical processes to maximize efficiency and usability. The new purchase experience was completely reimagined, offering a simplified and intuitive journey that significantly reduces the time needed to execute financial operations. Portfolio tracking was enhanced through an advanced dashboard that presents relevant metrics clearly and actionably, allowing users to quickly understand their investment performance. Finally, advanced custody filters introduce intelligent asset organization, making it easier to navigate and manage complex portfolios through customizable criteria and smart sorting algorithms.

Strategic Impact

Key Learnings

Simplicity vs Functionality

Finding the balance between simplicity and functionality was crucial. Beginner users needed a simple interface, while experienced investors demanded advanced tools.

Education as a Differentiator

Integrating educational content directly into the user experience proved to be an important competitive differentiator, significantly increasing engagement.

Trust in AI

Clients showed trust in receiving AI insights and also interest in paying for specialized human advisory services, opening up new revenue streams for the product.